Unified Managed Accounts

Why Watermark Private Portfolios?

The Watermark Private Portfolio Program is a Unified Managed Account using a multi-strategy, total portfolio solution consisting of stocks, bonds, ETFs, and managed investments all in one account. The benefits of utilizing the Watermark Private Portfolios are extensive.

Style

Diversification

Comprehensive

Reporting

Asset Allocation

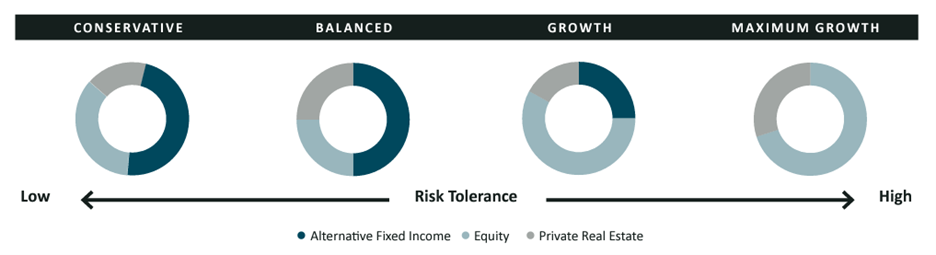

The Watermark Private Portfolio Program is designed for long-term investors who wish to build wealth by following an investment plan that may include an allocation to alternative assets. Your investment advisor will work closely with you to determine the optimal portfolio model that best aligns with your investment goals and level of risk tolerance.

When it comes to investing, the biggest challenge for investment advisors and their clients is finding a core investment solution that provides the opportunity for strong and predictable returns while managing the variability associated with the ups and downs of stock markets. And while investors understand the advantages of long-term investing, in practice, most investors have a tough time accepting and dealing with the volatility associated with investing in specific asset classes.

The Watermark Private Portfolio Program can provide additional tactical asset allocation, whereby the team can implement short term adjustments to asset allocations within the current market environment to take advantage of buying opportunities or protect from market drops. The goal of tactical asset allocation is to provide further fine-tuning of the portfolio according to the client risk profile, to improve the investment experience.

Watermark Private Portfolio Program

The Watermark Private Portfolio Program is a Unified Managed Account using a multi-strategy, total portfolio solution consisting of stocks, bonds, ETFs, and managed investments all in one account. This program is designed for long-term investors working closely with an advisor to determine the optimal portfolio model aligned with your level of risk tolerance and investment goals.

- Diversified Investment Style – Ability to delegate the investment process to pools managed by multiple portfolio managers all consolidated in one account.

- Access to Alternative Investments – Access to private lending pools, private real estate pools, and other alternative investments typically available to institutions, like pension plans or endowment funds.

- Enhanced Reporting – Comprehensive investment report which includes market commentaries, investment performance, performance attribution, portfolio activity with activity rationale.

- Fees – Management fees in non-registered accounts are tax deductible.

Core Positions

Core holdings in one or more portfolio pools will make up the bulk of the assets. Other investments may complement core holdings and may allow for tactical investment decisions for movement between asset classes and to provide diversification between asset classes, sectors, and geographical regions.

- Private Credit: Accessible though our affiliated investment fund manager, Willoughby Asset Management, the Rockridge Private Debt Pool provides consistent cash flows and enhanced returns.

- Private Real Estate: Accessible though our affiliated investment fund manager, Willoughby Asset Management, the Forsyth Private Real Estate Pool provides consistent cash flows, generally higher than those available through traditional bonds and/or bond proxies.

- Private Equity: Multiple core equity and/or balanced pools can be held in the Watermark Private Portfolio Program depending on the portfolio model selected. These pools are designed to give investors the ability to participate in upside during periods of equity market expansion and more importantly, protect capital when markets are not performing well. Most pools also have the ability to move in part or entirely to cash, and/or fixed income and/or commodities, etc. to protect capital.