Achieve Your Investment Goals with Private Assets

A Traditional Investment Approach Is No Longer Enough

Recent market volatility and economic shift exposed the limitations of the traditional investment approach. With stocks and bonds often moving in the same direction, investors can no longer rely on bonds to provide the same stability during market downturns. The traditional 60/40 investment portfolio (60% stocks/40% bonds) is ill-equipped to navigate the complexities of today’s markets.

Private Markets Investments Provide a Solution

Institutional investors, such as pension funds, endowments and foundations, have been allocating to private markets for years. But retail investors have limited access to these types of investments due to high investment minimums, limited availability and lack of expertise.

At Harbourfront, we have been making private markets solutions available to our clients since 2018, and we firmly believe that incorporating private assets into a modern portfolio is no longer optional—it’s essential.

Our independent advisors have access to unique private markets solutions built exclusively for our clients, that offer:

- Access to institutional quality global investment managers and strategies

- Diversification through multi-manager, multi-strategy investment pools

- In-depth due diligence backed by the Harbourfront Office of the CIO Investment Team

- Portfolio construction expertise

What are Private Markets Investments

Private markets include debt and equity investments made directly into private companies—companies that are not listed on public stock exchanges. Asset classes include:

- Private Debt

- Private Equity

- Private Real Estate

- Private Infrastructure

Benefits of Private Markets Investments:

Reduced portfolio volatility – Not subject to day-to-day price fluctuations of public markets, private market investments may lower overall portfolio volatility.

Enhanced diversification – Private assets offer lower correlations with traditional public markets, smoothing overall portfolio returns and mitigating volatility.

Potential for attractive returns – Private market assets are not immediately tradable. This “illiquidity premium” provides a unique advantage and may result in higher long-term returns compared to public markets.

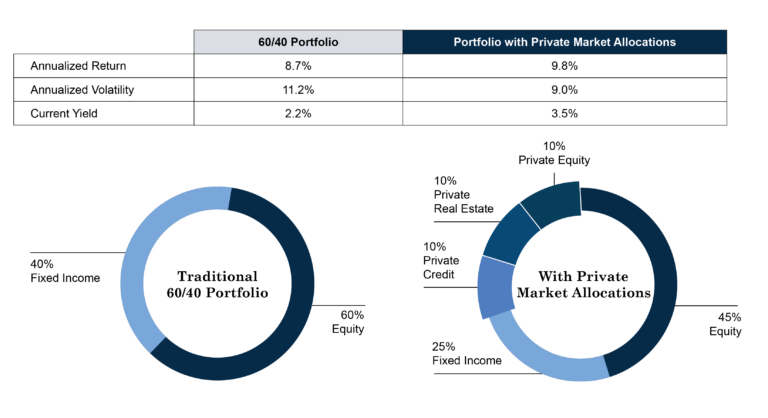

Allocating to Private Markets | An Illustration

2016-2023 (Earliest Common Available Data)

Source: Blackstone University Essentials: Private Estate. https://www.blackstone.com/pws/essentials-of-private-real-estate/

A Note on Risks

While providing various important benefits, private investments also carry some additional risks, which could be different from the risks associated with investing in public markets. It is important for investors to work with financial professionals who understand private markets and are able to make active investment decisions.

- Market risk – Private market investors may experience differentiated market risk compared to public market investments. Private companies are subject to different disclosure requirements and are sensitive to a variety of factors that may impact valuations differently than public markets.

- Liquidity risk – Private markets funds have varying liquidity profiles, often allowing liquidity on a monthly, quarterly, or less frequent basis. It is important for investors to understand the liquidity characteristics of private market investments before investing.

A Prudent Approach

The time has come for retail investors to apply the model of a pension portfolio to help provide a better overall investment experience of better returns with less risk.