COMPLEXITY, SIMPLIFIED

The Client Process

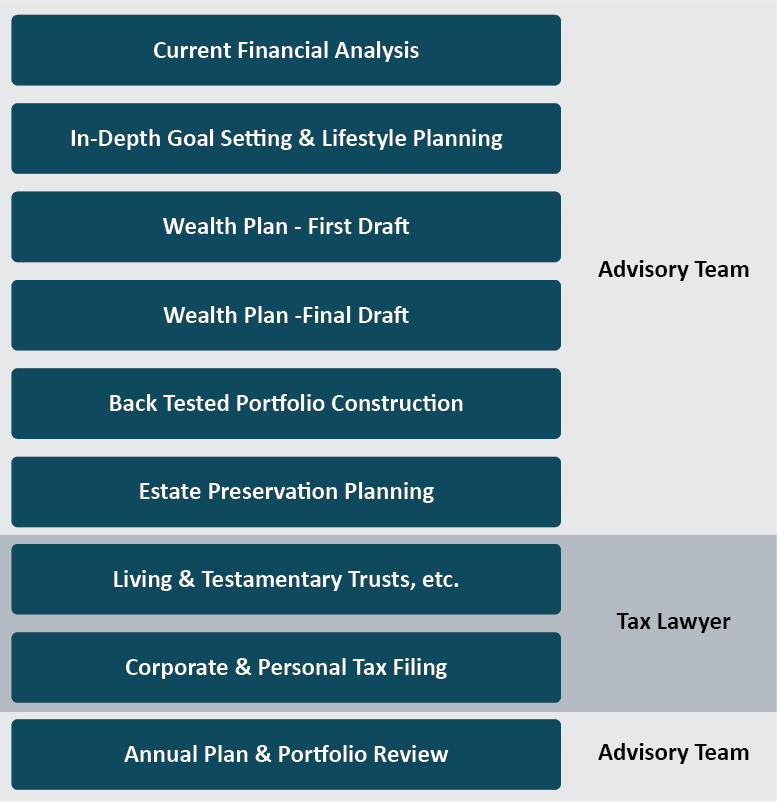

True wealth management involves an integrated, multilayered approach which follows a disciplined and pre-determined process.

Managing your net worth involves much more than your investment accounts.

Many of our advisors use an integrated, multi-layered approach encompassing tax minimization planning, portfolio construction and management, retirement income planning, trusts & estate preservation as well as risk management.

Our Multilayered Approach

Speak With An Advisor

We want to connect you with an advisor suited to your needs. Fill out the information below and we'll be in touch.

By submitting this information, you acknowledge that the information you are providing is subject to our Privacy Policy and Terms of Use and you consent that we may share your information with our internal team in order to best serve your needs.