2024 Global Economic Outlook

The month of January is named after Janus, the Roman god of new beginnings, who looks into the past and into the future. As timeless as New Year’s resolutions, January signals this transition, accompanied by a flurry of economic forecasts and market predictions to hopeful investors looking for promising new opportunities. In honour of Janus’ festivities, Harbourfront Wealth Management’s Office of the CIO presents its 2024 Outlook from Chief Investment Officer Christine Tessier.

2024 Economic Forecast

2024 Economic Forecast

Market participants closed 2023 on an optimistic note when the historic and assertive tightening interest rate cycle finally delivered more consistent signs of economic softening, with inflation measures dropping to more palatable levels. Elevated year-end optimism put a positive note on an otherwise difficult year, which saw a devastating rise in geopolitical tensions and war across the globe. Throughout 2022, 2023 and into 2024, Central bankers continue to manage the delicate balance between inflation vs. growth. Key areas of focus include demographics and job market dynamics, consumer spending, housing and the mortgage market, commodity prices (most notably energy), and the damage of super-sized public finance deficits.

Heading into 2024, here are our expectations for the year ahead.

- • We believe the economy is in a new economic regime, characterized by wider possible outcomes, persistently higher rates, continued tight financial conditions, and greater uncertainty.

- • In the face of uncertainty, we continue to expect market participants to be highly data sensitive, swinging between the hope for soft landing and the fear of a recession accompanied by a hard landing. H2 2023 economic data increased the probability (or hope?) for a soft landing, but we remain vigilant.

- • We expect inflation to continue to decline, likely settling at a level higher than the stated 2% target, reflecting the impact of important structural mega trends.

- • We anticipate that central bankers may drop rates later than expected in mid-year in 2024 to ensure existing tightening does not unnecessarily slow productivity. While moderate policy softening may occur in 2024 (1-2 rate cuts), we anticipate monetary policy to remain tight overall.

- • We expect Canadian and US growth to slow in response to the rate hiking cycle. That said, we expect employment to remain reasonably tight, reflecting key demographic trends around an aging population, urbanization, and immigration.

- • Growing divergence between US and Canadian economic data is expected, with Canada remaining more vulnerable to economic softness.

Canada’s economy appears more vulnerable to economic weakness due to its higher sensitivity to high interest rates because of higher levels of private sector debt and its mortgage market structure. The Canadian economy is concentrated by sector and highly cyclical due to its higher sensitivity to commodity prices, most notably energy. Canadian employment data has shown signs of weakness. Canadian policy rates could settle higher vs. pre-pandemic levels.

Canada’s economy appears more vulnerable to economic weakness due to its higher sensitivity to high interest rates because of higher levels of private sector debt and its mortgage market structure. The Canadian economy is concentrated by sector and highly cyclical due to its higher sensitivity to commodity prices, most notably energy. Canadian employment data has shown signs of weakness. Canadian policy rates could settle higher vs. pre-pandemic levels.

The US’ broad-based economy shows a surprisingly resilient, if slowing, growth trajectory. The US employment market, while softening, continues to be reasonably robust. The domestic residential market is less affected by the interest rate increase, given the long-term, fixed rate nature of many residential mortgages. Government initiatives, particularly in areas such as the semi-conductor industry and in artificial intelligence continue driving economic productivity. Key concerns include notable public market debt.

The US’ broad-based economy shows a surprisingly resilient, if slowing, growth trajectory. The US employment market, while softening, continues to be reasonably robust. The domestic residential market is less affected by the interest rate increase, given the long-term, fixed rate nature of many residential mortgages. Government initiatives, particularly in areas such as the semi-conductor industry and in artificial intelligence continue driving economic productivity. Key concerns include notable public market debt.

- • Mega forces reflect notable structural changes in the global economy. We recommend investors be mindful of four key mega trends, which impact our population, economies, and resulting investment opportunities in the marketplace. Please watch out for upcoming commentaries from the Office of the CIO on each trend.

- Demographic shifts: Includes themes such as a continued aging population, urbanization, and population migration & immigration.

- Increased geopolitical tensions: Includes themes such as de-globalization (both on-shoring, near-shoring), militarization & defense, changing economic relationships

- AI and machine learning: Technology enhancements are required to enhance productivity, and address growing needs

- Clean energy: Continued rise in natural catastrophes and global environmental goals & regulation have fuelled a clean energy revolution, causing structural shifts in the power & energy industry.

- • 2024 is set to be a historic election year, affecting more than 4 billion people (50% of the world’s population, in over 60 countries). Key elections to watch include the US, the EU, Taiwan, and India. Election results are expected to have a meaningful impact on how each mega trend is implemented.

For an interesting view on up-coming central bank action, you can view the following video where Dr. Ben Bernanke Decodes the Economy and Central Banks in 2024 (video) | PIMCO

2024 Market Outlook

2024 Market Outlook

Despite the harsh economic climate in 2023, markets taught the value of adapting to a new volatile macro regime, and how skilled investors can leverage mega trends when in search of opportunities. Public market participants were over-enthusiastic at the end of 2023 with the belief that interest rates have peaked and rate declines are imminent.

In 2024, we recommend investors continue to take a targeted approach to their macroeconomic exposures to position themselves to benefit from long-term mega trends. Given the expectation of continued disparity in returns between asset classes, sectors, and regions, we recommend a targeted, active investment approach that leverages key mega trends.

In Public Equities

- • Equities continue to be a relevant asset class in an environment where inflation remains an ongoing concern. Despite the year-end market optimism on declining inflation and rates, we continue to view inflation as an ongoing and potentially entrenched consideration. Although not an explicit inflation hedge, equity returns are expected to exceed inflation over the long-term, albeit with short-term volatility.

- • Strong market buzz around artificial intelligence and machine learning continues to underpin US stock performance. The sector continues to face challenges around the reasonableness of valuations as well as risks around antitrust regulation and litigation.

- • Equity markets are likely to continue to exhibit key themes such as consolidation in US mid-market banking as well as opportunities in the US semi-conductor space, clean energy infrastructure and technology as well as health care.

- • In the pro-cyclical Canadian equity market, the energy sector remains vulnerable to two key mega trends: increased geopolitical tensions and the clean energy revolution. A focus on high-quality names that are best positioned to address these two themes is expected to be beneficial.

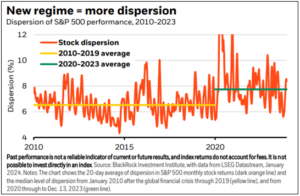

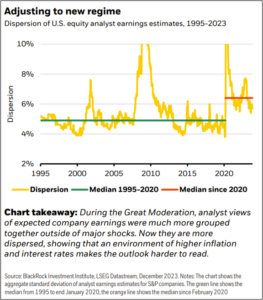

- • The new macroeconomic regime leads to more dispersion between individual stocks. The charts below, from the Blackrock Investment Institute, illustrate an increase in return dispersion between individual stocks. Similarly, the new regime makes earnings more difficult to predict, as is reflected in the dispersion of US equity analyst earnings estimates.

In Public Fixed Income

- • A major regime shift was revealed throughout the latest rate tightening cycle, as fixed income—a category traditionally associated with stability and negative correlation to equities—continues to exhibit positive correlations with equities and high levels of volatility.

- • Markets reflect the tug-of-war between a loose and sizeable fiscal impulse versus tight monetary policy, working against each other and adding volatility. New bond issuance reflects strong supply in government bonds while corporate issuance has been comparatively light.

- • At current interest rate levels and within existing supply/demand dynamics, fixed income—particularly investment grade fixed income—offers a competitive source of liquid income. We recommend a revaluation, and possible reduction, in the role government bonds play as a shock absorber in diversified portfolios given their current high level of volatility.

- • Uncertainty regarding the path of future policy decisions make longer-term bonds a riskier decision. We observe that many investors remain in shorter-term fixed income to minimize volatility. We expect that longer dated bonds, particularly around the 10-year window, will continue to experience volatility.

In Private Markets

Private assets, by their nature, adjust more slowly to new market information and are less prone to short-term changes in sentiment. Before diving into our outlook for 2024, we provide the following updates on the environment for privates for context from 2023.

- • Even though the market optimism ended the year stronger than expected, the higher rate environment and economic uncertainty naturally put pressure on fundraising. The soft economic environment throughout 2023 saw an extension of fundraising periods beyond the typical 12–24-month periods.

- • Private markets saw a notable drop in institutional demand throughout 2023. This resulted from the fact that, following the historic drop in public market assets in 2022, institutional portfolios began 2023 already heavily overweight in private market assets, with no further need to add to private allocations. This market condition is referred to as ‘the denominator effect.’

- • Private market asset managers spend much of 2023 focused on diversifying their client base to include high-net-worth and retail clients into the fold. The universe of retail vehicles available (e.g., business development corporations) saw a notable expansion.

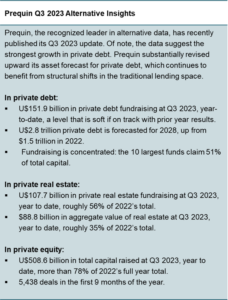

- • In terms of asset class focus, private debt continues to be belle of the ball. Private credit is well-positioned as an alternative source of credit in the current market, where traditional lenders such as banks face increasing pressure and tightened lending conditions. And despite economic pressure, private debt held its own, putting up respectable fundraising numbers.

- • The market remained concerned about real estate values and whether declines were fully reflected in pricing. Private real estate sectors experienced dispersion in performance and market support, where the Residential sector benefitted from supply-demand imbalances in several regions while the Retail and Office sectors continued to remain out of favor. New sectors such as Storage and Student Housing caught the attention of investors and continued to grow.

- • Economic uncertainty also meant that the infrastructure sector, poised to benefit from several key themes such as clean energy and urbanization, did not see as much fundraising as might have been expected. This is expected to correct in 2024.

- • Higher borrowing costs and low valuations were particularly challenging for private equity. Investors were focused on liquidity even in this illiquid category, putting pressure on private fund distributions rather than on traditional return measures (i.e., focus on DPI vs. IRR (Distributed to Paid-In Capital vs Internal Rate of Return)). The focus on liquidity was positive for the private equity secondaries market, which continued to expand in 2023.

As we look forward into 2024, we continue to see a number of key trends affecting the private markets.

- • The “retailization” of private assets will continue into 2024. Alongside the increased distribution into a non-sophisticated investor space, increased product structure complexity and regulation is also anticipated.

- • In tandem with the expansion of ‘retailization,’ we foresee other, more liquid areas of the private markets will continue to prosper, most notably the private equity secondaries market.

- • We anticipate further consolidation in the alternative space, driven by two key trends. First, traditional managers struggling to grow assets are looking to add the high-margin, high-demand private strategies to their product rosters. Second, alternative managers continue to expand their own platforms globally through actions (e.g., by sector, style, geography) to provide revenue diversification and enhanced liquidity features.

- • We expect to see the freeze in institutional demand ‘unthaw,’ with a moderate and targeted demand returning to the market in 2024. This is supported by late 2023 private equity data, which shows that private equity exist strategies and mergers and acquisitions (“M&A”) activity is returning to the marketplace.

- • We continue to support environmental, social and governance (“ESG”) themes and view private markets as a unique and often more targeted way to execute on key themes. Examples include AI and machine learning, clean energy, and social housing. Regulation driving institutional investment into these themes will continue to be supportive of product development in these areas.

We close in reminding investors that the objective of this outlook is not to predict the future, but to consider the most important factors in making decisions today. Janus and the spirit of the New Year encourages us to transition from that reflective pause on a year gone by to welcome the breath of possibility synonymous with new beginnings. We are convinced that, while 2024 presents new and unique challenges, exiciting opportunities abound. Happy investing!

If you would like to discuss your portfolio, I’d encourage investors to connect directly with your advisor.

Disclaimer

I, Christine Tessier, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

A Temporary Truce: The US-China Trade War

14 May 2025