The Nearly Everything Market Rally

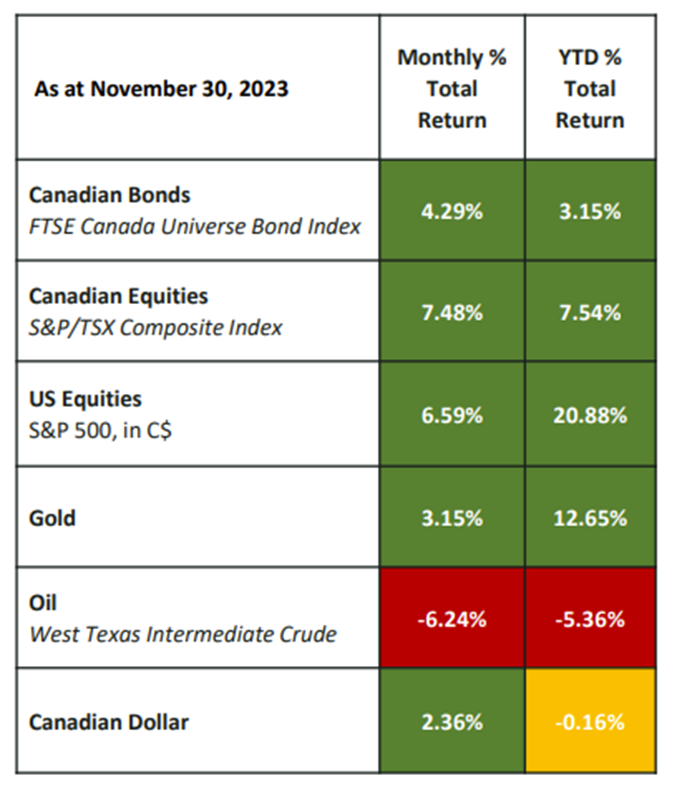

Markets took a break from the 2023 “higher for longer” view. Instead, correlations between bond and equity markets continued to be positive, with risk assets rallying together across the public markets. Reversing its 3-month negative course, equity markets registered a phenomenal month, and credit joined the fun, although Canadian credit markets significantly underperformed the US.

An industry veteran with over 20 years of experience as a Chartered Financial Analyst and Chartered Alternative Investment Analyst, Christine Tessier, Chief Investment Officer at Harbourfront Wealth Management, brings extensive due diligence and product development experience across asset classes.

Here, Christine Tessier shares her perspective:

Equities, heavyweights, and the lagging energy sector

Both Canadian and US equities registered strong monthly gains. Gains were broad-based, across many companies and sectors. Technology giants returned to centre stage, as heavyweights Apple and Nvidia both beat earnings expectations. Market participants continue watching for inflation, including energy-driven inflation, as we head into the winter months. And despite ongoing global conflicts in the Ukraine and the Middle East, energy prices have not recorded any escalation so far. Oil prices, as represented by international benchmark Brent Crude, declined again in November, falling below $80/barrel and currently trading at the lower end of its two-year range. The Energy sector was this month’s laggard.

Fixed income rallies to close out the year

A persistently grim and uncertain economic backdrop weighed down fixed income throughout 2023. It wasn’t until October, when fixed income markets finally saw the glow of a silver lining, as economic data in the US and Canada finally recorded signs of a slow-down in inflation.

Unconvinced, the Federal Reserve and Bank of Canada held the overnight rates steady at 5.50% and 5.0% respectively, to be sure inflation was headed downward. Still, fixed income markets joined equities in a euphoric rally at the thought that the rate hiking cycle may have reached its peak. Fixed income rallied hard in November, with both Canadian and US investment grade credit tightening significantly (Canada: 13 basis points to 1.42%; US 24 basis points to 1.04%).

Three important trends affecting private markets

Private assets, by their nature, adjust more slowly to new market information and are less prone to short-term changes in sentiment. Unsurprisingly, November illustrated three continuing trends affecting private markets today: (a) a shift in the price of risk across risk assets; (b) positive structural tailwinds that continue to support the expansion of private markets; and (c) continued economic uncertainty.

(a) A change in the price of risk across risk assets

The increase in interest rates means investors no longer need to take on high levels of illiquidity and credit risks to achieve a reasonable return.

Today, cash returns have increased, and for many investors, the income provided by the risk-free rate is sufficient. What has been the implications for private assets?

A rise in interest rates impacts private assets in the same was as other risky assets, as all assets are priced off the yield curve. Private assets are unique, however, in taking more time to reflect changes in market environment and not reflecting short-term changes in investor sentiment.

At low rates, asset classes such as investment grade private debt were yielding approximately 6%–7%, a spread of 4% above the risk-free rate of 2%. Today, with the rapid rise in rates, private assets find themselves in an interim state, whereby existing exposures do not yet fully reflect the market environment. The same investment grade private debt exposure referenced above continues to offer this 6%–7%, though its spread currently represents 2% above a risk-free rate of 5%, a much different economic proposition for investors considering illiquidity risk.

We’re viewing private asset allocations as being in an ‘interim period,’ where it will take a few quarters for updated underwriting—even in floating rate securities—to reflect the increase in interest rate environment. Different risk assets will adjust to this change in economic environment at a different pace, with the most liquid areas such as mortgages and floating rate securities adjusting quicker than their fixed rate and private equity counterparts. Private markets are also less subject to month-by-month sentiment fluctuations and tend to reflect longer-term trends.

November exhibited an increase in spreads available on mortgage securities. Floating rate securities, which typically adjust their coupons on a quarterly basis against a reference index, are also steadily rising.

(b) Positive structural tailwinds

Despite an interim period, whereby private asset return spreads are compressed, private markets continued to provide strong structural tailwinds.

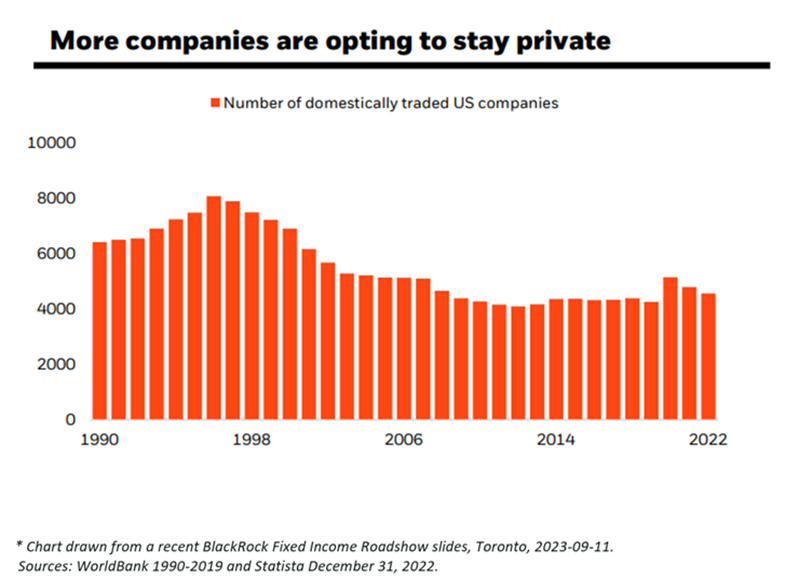

Declining availability of capital in public markets. Increased regulation, tightening bank lending conditions, and consolidation in the US banking sector continue to steer many borrowers to private market lenders who are willing and able to underwrite credit risk.

Flexible capital is critical, particularly in economic uncertainty. Concerns about a recession mean many borrowers and private equity GPs require flexibility in the management of their capital structure. The ability of private lenders and underwriters to provide flexible capital terms is a critical advantage that is particularly important in difficult economic environments.

Company diversification is high in private markets. As public market bond issuance continues to see a trend towards larger bond issuance by fewer companies, private lending continues to exhibit a very high level of breadth.

Key themes are primarily available via private markets. There are significant, multi-year macro themes currently underway where private markets, particularly private equity, are best positioned to provide investor access. Examples of these themes include clean energy and infrastructure development, as well as artificial intelligence.

(c) Continued economic uncertainty and its impact on private markets

During periods of economic uncertainty, we can expect that across private assets, liquidity will become increasingly important, private debt default rates will increase, and private equity capital will slow.

While we concur with these eventualities, we’d like to highlight the defining feature of private markets: asset manager participation. Moreso than equities, private markets exhibit a strong gap between its strongest participants vs. weakest participants. It is during recessions that diversification, manager quality, and the ability to target specific positions becomes important. In underwriting private assets, managers are modelling results across the economic cycle. The strongest managers in underwriting have built robust portfolios able to withstand a possible recession. Strong managers are also often sole lenders, or part of a small ‘club’ of allocators, and therefore have a higher degree of flexibility when restructuring existing problem loans and recovering assets. November continued to exhibit this phenomenon as loan loss rates ticked up, while leading asset managers continued to record low levels of defaults.

‘Tis the Season: Looking back at 2023 and ahead into 2024

As we head into the bustle of the holiday season, it is a good time to take stock of year’s events.

2023’s economic backdrop was not ideal, with discussion mired in the delicate balancing act between quelling peak level inflation vs. managing growth. Concerns over recession risk, high government debt levels, wage pressures, and geopolitical tensions are only a few of the salient topics facing investors.

On the back of 2022—one of the worst years in terms of both bond and equity market performance since the late 1920s! —it’s worth noting that public markets recovered reasonably well in 2023, with positive returns in both equity and fixed income markets on a November year-to-date basis. Similarly, in early 2023, private markets—particularly private credit—benefitted from tightened lending conditions, providing stable and diversifying returns to our clients.

Looking ahead to 2024

- – Current rate levels make public fixed income an asset class that can no longer be ignored. In particular, the deep and diversified US credit market offers many unique and diversifying sources of income.

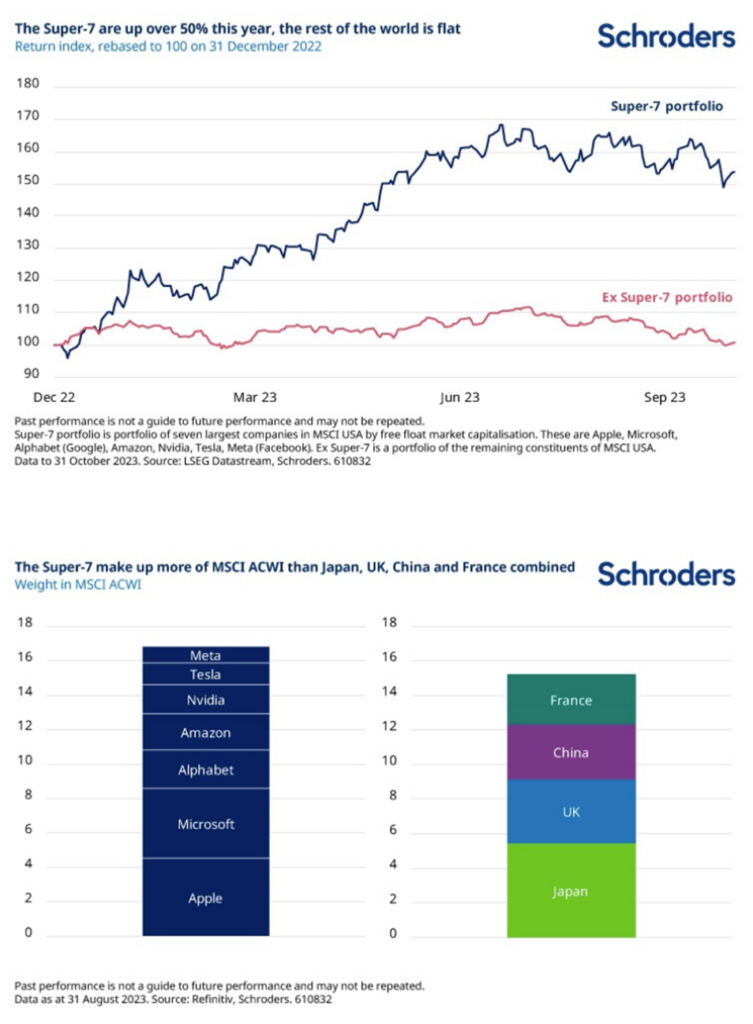

- – In tandem with our view that longer-term inflation is unlikely to return to 2% levels, we believe equities will benefit from a pro-cyclical environment. And while the US market remains a stalwart portfolio component, at current valuations—heavily driven by six technology sectors—it’s worthwhile considering other areas of the global equity space offering a stronger relative value, most notably Japan and the UK.

- – While we expect to see an uptick in private credit default rates, we believe this is the time when we see ‘who is swimming naked when the tide goes out.’ The strongest managers are often difficult to access with high asset size requirements. We expect that 2024 will highlight the importance of having a focus on the strongest managers whose credit underwriting is robust in a recessionary environment.

- – In private equity assets, taking targeted exposures rather than allocating to broad-based themes is likely to benefit in the year ahead. A key example of this theme is real estate, where the new year is likely to bring further pressure on the traditional office sector, while sectors such as apartment rentals continue to benefit from rising rents, high immigration, and tight supply across North American housing.

- – Diversification is particularly critical in private equity allocations, where primary and secondary markets tend to have an inverse relationship: a prosperous economy lends itself to strong deal activity in the primary equity market. Conversely, economic strain tends to provide opportunities in the secondaries market.

Overall, we continue to favour an institutional approach, allocating strategically across asset classes. We emphasize the importance of diversification in helping clients access liquidity, particularly in higher recession-risk environments. Designing portfolios with targeted rather than broad-based exposures will be important to preserving capital for investors in 2024 and beyond.

If you would like to discuss your portfolio, I’d encourage investors to connect directly with your advisor.

Disclaimer

I, Christine Tessier, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q2 2025

7 July 2025