AI Trends - 2026

AI – By the numbers:

Economic Impacts

- In the first half of 2025, AI-driven capital expenditures in software, R&D, data centers, and hardware contributed approximately 1.3 percentage points to U.S. real GDP growth in Q1 and a 1 percentage point in Q2. AI-powered growth: GenAI spurs US economic performance | EY – US

- AI could raise global GDP levels by ~1.5% by 2035, with further growth to ~3% by 2055 and ~3.7% by 2075, driven by lasting productivity gain. The Projected Impact of Generative AI on Future Productivity Growth — Penn Wharton Budget Model

- AI spending in North America is expected to accelerate, with global AI infrastructure investment projected at $1.4 trillion and total AI spending exceeding $2.5 trillion in 2026—a 44% year-over-year increase. Gartner Says Worldwide AI Spending Will Total $2.5 Trillion in 2026

Financial Market Impacts

- Tech stocks tied to AI now represent over 25% of the S&P 500, making AI the single largest growth driver in U.S. equity markets AI stocks, alternatives, and the new market playbook for 2026 | BlackRock

- NVIDA continues to be regarded as the top performing AI stock, holds approximately 85% of the data center GPU market, boasts a gross profit margin of 70% and a net income margin of 53%, Nvidia’s 85% GPU Market Share Faces Growing Competition: Is This AI Stock Still a Buy for 2026? | The Motley Fool

- Retail investor sentiment: A January 2026 survey found 93% of AI stock investors plan to hold or buy more, signaling strong continued retail enthusiasm The Motley Fool’s 2026 AI Survey: Only 7% of AI Investors Plan to Sell | The Motley Fool

- AI-driven algorithms now execute approximately 60–75% of equity trading volume in U.S. and major global markets; some estimates push this to ~89% of global trading volume The Use of AI and AI Algorithms in Financial Markets – Michigan Journal of Economics

AI Adoption

- 78% of enterprises globally use AI in at least one business function (up from 55% in 2023) AI Usage Statistics 2025: The Complete Market & Adoption Report – Elfsight

- Generative AI enterprise spending soared to $37 billion in 2025—more than triple the prior year with enterprise growing faster than any software category in history 2025: The State of Generative AI in the Enterprise | Menlo Ventures

- Retail holiday shopping via AI surged 693% YoY during Nov–Dec Consumers spent more on mobile apps than games in 2025, driven by AI app adoption | TechCrunch

- AI productivity premium: Firms with robust AI adoption report efficiency improvements and a 56% wage premium for AI skills PwC 2025 Global AI Jobs Barometer — Press Release | PwC Ireland

AI – A Recap

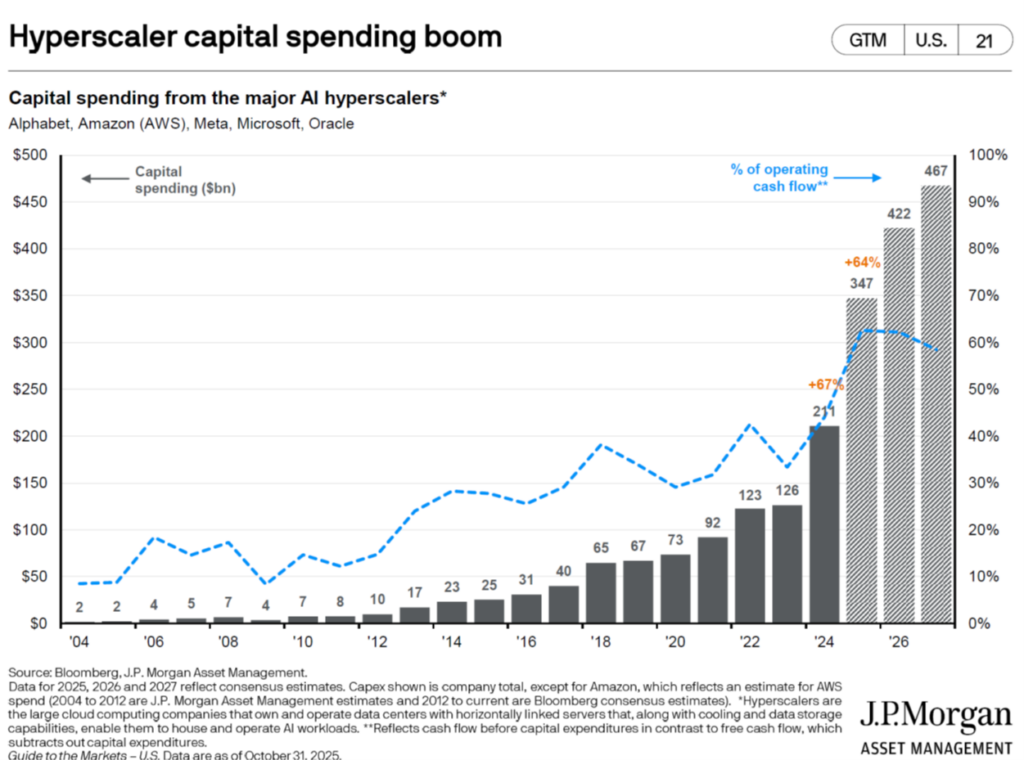

As artificial intelligence has moved from niche uses to broader business and consumer adoption, investors have benefited from sustained AI enthusiasm for over three years. By October last year, AI-related companies had accounted for an estimated 80 percent of stock market gains in the U.S.; at one point, Nvidia, the dominant manufacturer of AI-enabling GPU chips, comprised a stunning eight per cent of the total market capitalization of the S&P 500. OpenAI, meanwhile, announced plans for capital expenditures of $1 trillion over five years (roughly equivalent to the GDP of Switzerland), while other companies, including Nvidia and so-called hyper-scalers such as Microsoft, Google and Amazon, have also embarked on huge AI capex programs.

We provided an overview of those developments in our commentary last November, which discussed the over-arching trends and market implications of the “AI revolution.” Now, as we look forward through 2026, we want to dig a little deeper in a series of articles that will explore what we see as meaningful concerns and potential opportunities in the AI space.

The “boom or bubble” debate

Understandably, much of the high-level analysis of the AI rally focuses on a simple dialectic: Is this a boom or a bubble? The trouble is that an investor could make a reasoned argument for either.

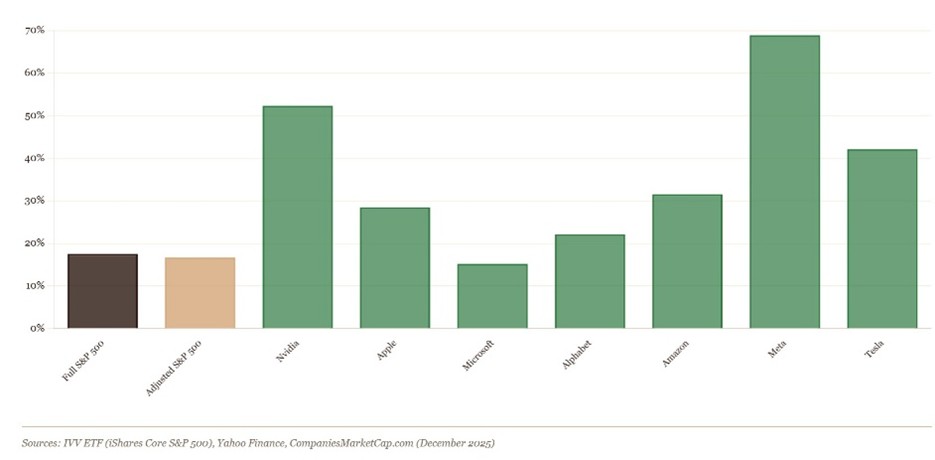

On the one hand, the valuations of many AI-related equities are truly stratospheric. For example, Nvidia’s market cap in early January was more than US$4.5 trillion, up by a factor of about seven from just three years ago. The degree and duration of the AI-driven bull market are reminiscent of bubbles of the past, especially the dotcom and telecom rallies of the late 1990s and early 2000s, and the U.S. market concentration in technology and related firms is even higher today. If this is a bubble, it is certainly a big one.

2025 returns of largest AI-related stocks by market cap

On the other hand, unlike many historical busts, the major players in the AI space are real companies with robust revenue streams. These are, by and large, not akin to Pets.com, which never turned a profit in the nine months between its IPO in 2000 and its bankruptcy just nine months later, becoming the poster child for the Internet bubble. By contrast, Nvidia reported record revenue for its fiscal 2026 third quarter (ended Oct. 26, 2025) of US$57 billion, up 62 percent year-over-year. The company’s price-to-earnings ratio sits above 45, which is undoubtedly high, but not excessively so compared to industry peers or to the valuations of some tech companies 25 years ago. Back then, networking hardware manufacturer Cisco’s stock reached a peak P/E of 200; Microsoft’s hit 73. By comparison, the current valuations of the AI market darlings might seem downright reasonable.

The current AI-driven market differs fundamentally from the late‑1990s dot‑com era in several key dimensions. First, today’s AI leaders—such as Nvidia, Microsoft, and Alphabet—are generating robust cash flows and positive free-cash-flow margins from existing enterprise and cloud services. Secondly, the dot‑com bubble lacked structural depth: internet startups often featured negative EBITDA, negligible capital discipline, and pure consumer adoption narratives. Today’s AI ecosystem encompasses not only software but hardware (GPUs, silicon), data centers, enterprise SaaS, and vertical-specific automation. The ecosystem’s diversity creates multiple revenue pathways and mitigates binary outcomes. A University of California, Berkeley study acknowledges limits to LLM scaling, but also suggests a “reset” rather than collapse—leading to a pruning of weaker ventures while allowing specialized or hybrid AI paradigms to succeed. This ecosystem resilience contrasts sharply against the singular internet playbook of the dot‑com era.

Third, investment patterns today exhibit signs of discipline. Infrastructure scaling which incorporates chips, data centers, and electric power is being financed by substantial cash reserves and debt, and not leveraged speculative equity financings as in 1999–2000. Ultimately, structured capital deployment is predominantly defensive, focused on establishing economies of scale and competitive moats rather than fueling speculative frenzies

Where dot‑com assets imploded due to fundamental hollowness, today’s AI champions are anchored by revenue durability, free-cash-flow generation, and strategic infrastructure investments. Even if a correction or “reset” removes froth from speculative segments, the underlying thesis of AI as a structural growth catalyst remains intact.

Thus, this is not a classic bubble in the mold of 2000. Instead, we’re witnessing a maturation of foundational technology where valuation multiples appropriately reflect earnings-generating capacity—signaling growth with accountability, not irrational exuberance.

A third way for investors?

If we step back and take a longer view, a few things become clearer. For one, there will undoubtedly be peaks and valleys in the AI rally. In the U.S. market, much is riding on the success of OpenAI right now, but over time new entrants and market failures will inevitably create winners and losers. Given this, a reasoned approach would attempt to look beyond the boom/bubble debate and take a more nuanced view of the opportunities in and concerns over AI.

Investors need to be aware of and ready to respond to the areas of potential vulnerability that have been built into the market as it rides the AI wave. Especially in a market that is so highly concentrated, diversification seems to us not only prudent, but critical.

What does such diversification look like? One approach, which we will more fully explore in an upcoming commentary, is to look beyond the hyper-scalers in AI to the sectors that stand to benefit from AI’s growth and may offer investors exposure to this transformative technology while mitigating volatility.

Diversification amid a historic market rally may sound boring, sure. But one thing even the most transformative technology will not change for investors is the wisdom of not putting all your eggs in one basket.

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, Theresa Shutt, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

AI Trends – 2026

20 February 2026