The AI revolution - key trends and market implications

The AI revolution

Artificial intelligence (“AI”) has rapidly evolved from niche applications – like virtual assistants (Siri) and recommendation engines (Netflix) – to a transformative force reshaping industries and society. The launch of ChatGPT in November 2022 marked a turning point, making AI accessible to millions and sparking unprecedented growth in consumer adoption.

Drivers of AI advancement

Three critical factors have fueled AI’s rapid progress:

- Big Data: The exponential growth of available data.

- Computing Power: Massive increases in computational capabilities.

- Machine Learning Breakthroughs: Significant advances in algorithms.

Today, businesses are racing to adopt AI, often without fully understanding its capabilities or strategic value. Buzzwords like “optimization,” “scaling,” and “maximizing efficiency” abound, but the real impact of AI remains to be seen.

Like a genie expected to grant unlimited wishes, AI promises profound economic, political, and societal changes. Advocates highlight its potential to boost productivity, drive innovation, and revolutionize healthcare. Skeptics warn of job displacement, information manipulation, privacy erosion, and the end of humanity as we know it. Confusingly, many Silicon Valley executives take both sides.

Understanding AI

Artificial Intelligence refers to computer systems capable of tasks that typically require human intelligence—learning, reasoning, problem-solving, and language understanding.

Categories by capability

- Artificial Narrow Intelligence (ANI): Specialized for specific tasks (e.g., virtual assistants, image recognition).

- Artificial General Intelligence (AGI): A theoretical form of AI with human-like cognitive abilities.

Categories by technology

- Machine Learning (ML): Systems that learn and improve from experience.

- Generative AI: Creates new content (text, images, audio, code) by learning patterns from existing data, as seen in models like ChatGPT.

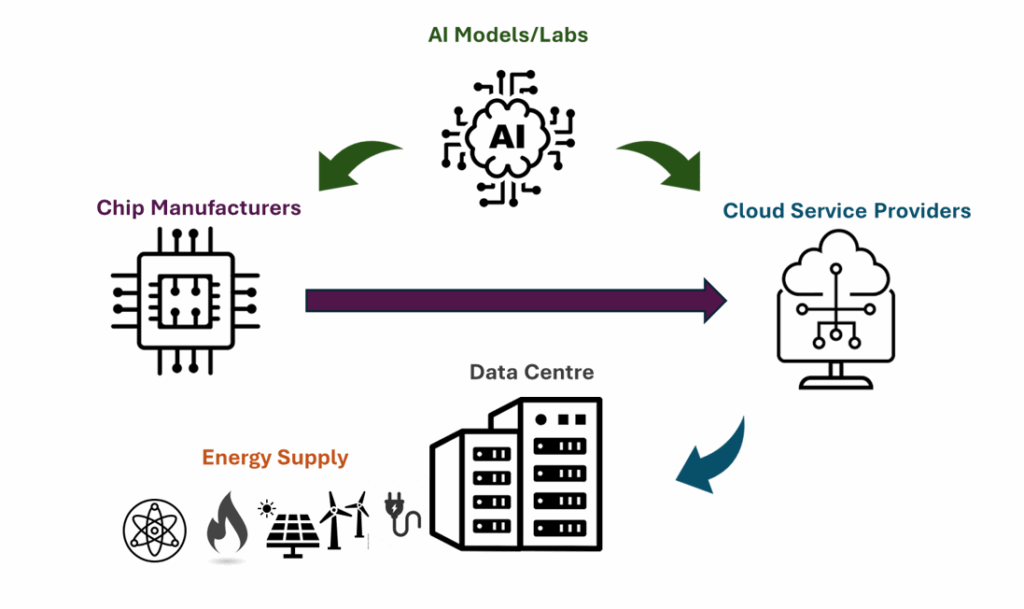

AI value chain

While AI is referred to as the technology used to enable AI solutions, AI relies on various components – often referred to as the AI value chain or ‘stack’:

AI Labs – model development

AI labs are where AI models are built and trained using prepared data. This layer includes the software (chatbots) which are crucial for integrating AI into existing systems. Companies that offer AI lab software similar to ChatGPT include Google DeepMind (Gemini) and Microsoft (Copilot).

Cloud service providers

Hyperscale cloud providers — Amazon Web Services, Microsoft Azure, and Google Cloud – host the AI labs’ software. These firms acquire semiconductor components, acquire land, secure long-term electricity supply, and manage extensive data centre infrastructure.

Datacentres

A datacenter is essentially a warehouse of computers running nonstop, requiring land and power with direct links to transmission lines and fibre networks. Artificial intelligence (AI) model training and deployment occur mainly in data centres with AI’s high-power demand being met by a combination of energy sources, including renewable power, natural gas and coal.

Chip manufacturers and networking infrastructure

Chip designers and manufacturers such as Nvidia design the Graphics Processing Units (GPUs) that power the deployment of AI models. GPUs are able to perform vast numbers of calculations rapidly and simultaneously, enabling the training and deployment of complex AI models that were once impossible to imagine. Companies such as Broadcom manufacture high speed ethernet switches to connect computing units and AI data centres.

This interdependent approach to the AI stack has set the tone for the industry, resulting in a division of labour among the key players. AI labs like OpenAI and Anthropic devise the cutting-edge models. Chipmakers like Nvidia and AMD design the graphics-processing units (GPUs). Cloud “hyperscalers” like Microsoft and Amazon host the labs’ models on GPUs purchased from the chip firms. Key players collaborate when useful and compete as needed.

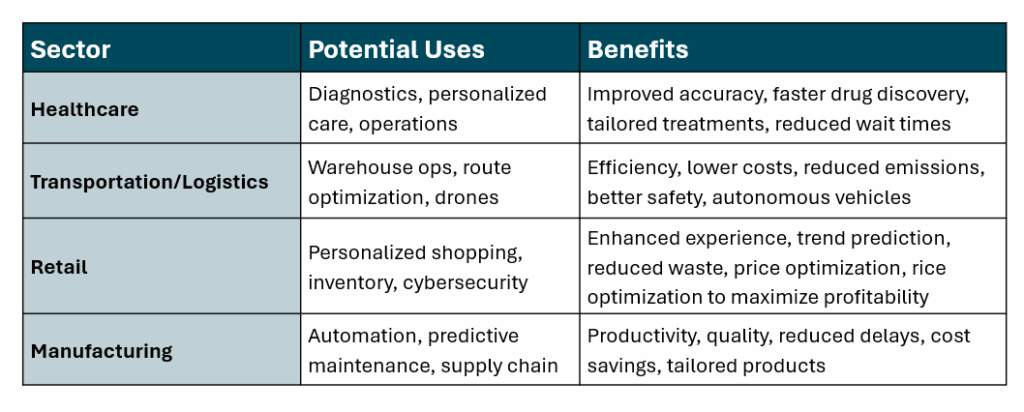

Applications of AI

With all the money flooding into building infrastructure to support AI and provide the computing power needed, one must ask whether the investment will be worth it? The below table highlights a small sample of the potential benefits of AI by industry sector.

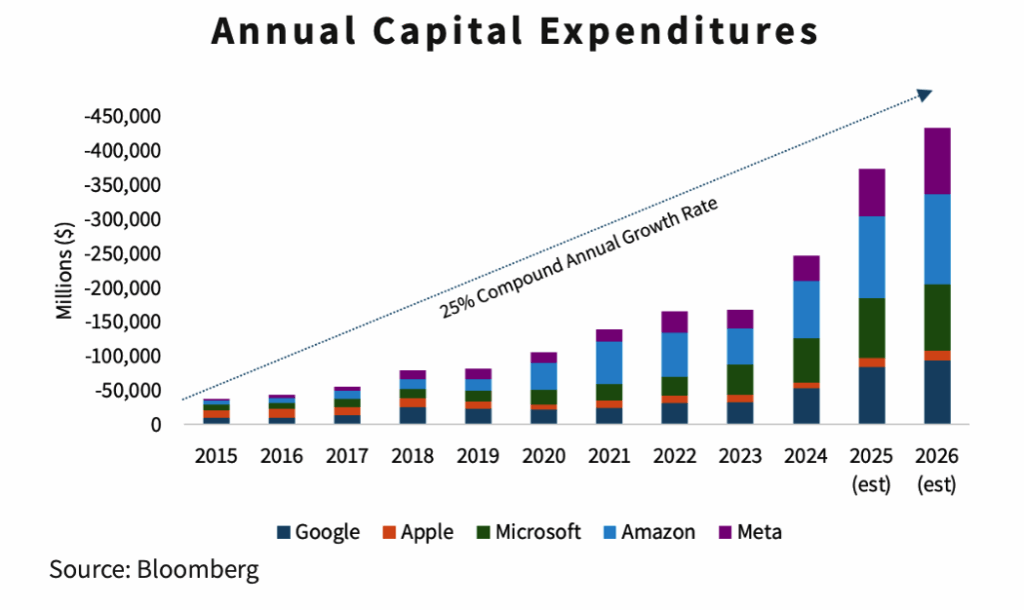

What is AI capex?

AI capex refers to the money spent to build out artificial intelligence capabilities, primarily through the construction of data centers and the purchase of high-end chips and hardware. This massive spending is driven by the need for immense computing power to train and run AI models, leading to the current “AI capex supercycle” as tech giants compete to stay ahead. Often referred to as the “hyperscalers”, these tech giants – Microsoft, Amazon , Meta and Alphabet – are expected to spend a combined $350 billion over 2025 in AI capex.

Much of this capex has been on data centres; the data centre market has doubled in size since 2020, with a compound annual growth rate of 21% and vacancy rates rapidly approaching zero1. Mark Zuckerberg revealed his planned “Hyperion” mega-data center with a social-media post showing it would be the size of a large chunk of Manhattan. OpenAI’s Sam Altman calls his data-center effort “Stargate,” and has announced at least $1 trillion in data-center investment2.

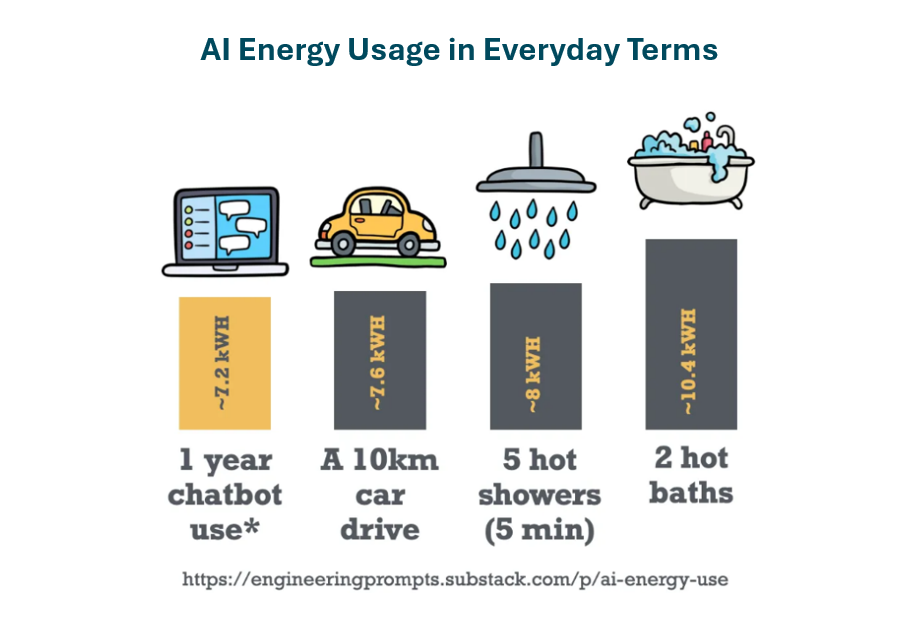

Energy requirements

Widespread adoption of AI has led to increased interest in its energy consumption. According to a recently released Google report on energy usage for a single query for their Gemini app, a median prompt consumes 0.24 watt-hours of electricity, the equivalent of running a standard microwave for about one second. As of 2024, electricity consumption from data centres was estimated at 415 terawatt hours (TWh), equivalent to 1.5% of global electricity consumption3.

Global electricity consumption for data centres is projected to double, reaching approximately 945 TWh by 2030, representing just under 3% of total global electricity consumption in 20304.

Based on the above estimate, the increase in emissions from data center electricity demand will be small in the context of the overall energy sector and could potentially be offset by emissions reductions enabled by AI. Additionally, as AI becomes increasingly integral to scientific discovery, AI could accelerate innovation in energy technologies such as batteries and solar PV.

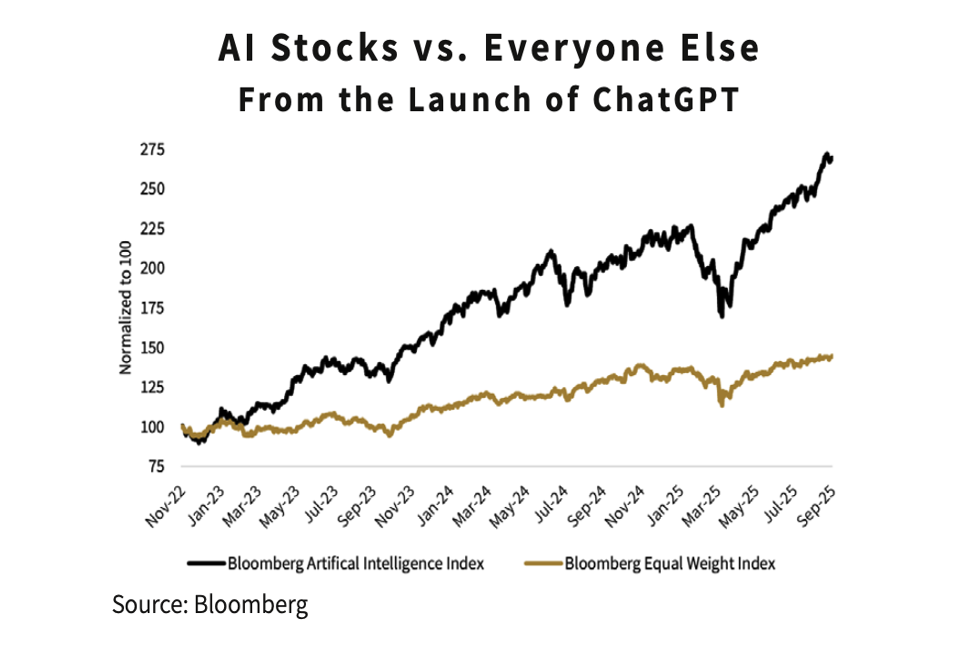

AI and equity markets

Since the release of ChatGPT in 2022, the value of America’s stock market has risen by $21trn. Just ten firms—including Amazon, Broadcom and Nvidia—account for 55% of that rise5. For 2025, an estimated 80 percent of U.S. stock gains this year came from A.I. companies6.

On October 29th, Nvidia made history as the first company to reach $5 trillion in market value (bigger than Germany’s GDP!). The sustained demand for Nvidia’s chips underscores the massive infrastructure build-out to support AI workloads, from generative AI to advanced analytics.

Boom or bubble

For some, it feels like we’ve been here before.

There are many similarities between the late 1990s internet stock bubble and the current AI boom, with both periods pushing stock valuations to new heights. In the late 1990s of the dot-com boom, investors poured their money into speculative internet-based companies while telecom firms took on massive debt to build out fiber-optic infrastructure. The dot.com business model was ultimately flawed, however. The profits never materialized and hundreds of dot.com companies went bankrupt with the Nasdaq losing three-fourths of its value.

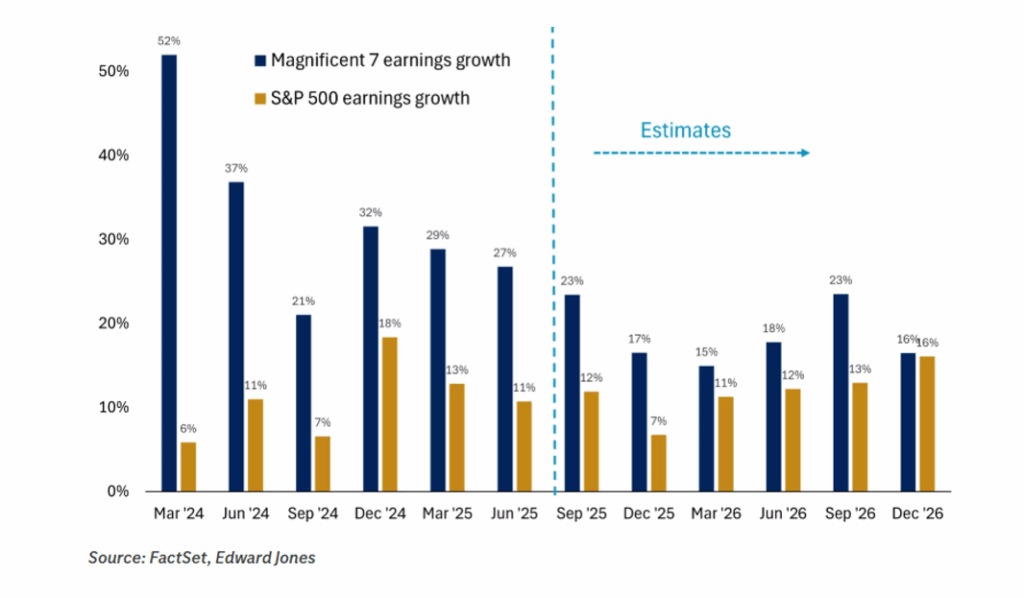

Unlike the dot-com bubble, however, today’s bull market is being led by companies that are highly profitable with diverse revenue streams. Secondly, AI investment by the mega-cap tech companies have been made through internal cash flows, not debt. Third, while elevated, valuations are not as extreme as in 2000 with profits driving the rally instead of hope. AI companies are expected to continue to perform as computing power increases, industry adoption grows, and technology improvements lead to greater productivity and convenience for society.

According to this argument, as long as AI tech can keep getting better, then AI companies can keep getting more valuable.

Based on third quarter earnings, AI companies continued to beat expectations.

The biggest question is how quickly investment in AI can lead to actual AI related revenues.

Over 2024, there was just around $45 billion of revenue for AI products7 globally. Consumers have been quick to use AI, but most are using free versions while businesses have been slow to shell out for AI beyond the roughly $30 a month per user for Microsoft’s Copilot.

OpenAI recently committed to pay Oracle an average of $60 billion annually for servers in data centers in coming years. However, OpenAI is on track to take in just $13 billion in revenue from all its paying customers this year8. Bain & Co. estimated the wave of AI infrastructure spending will require $2 trillion in annual AI revenue by 2030 to pay back investments to date. By comparison, that is more than the combined 2024 revenue of Amazon, Apple, Alphabet, Microsoft, Meta and Nvidia, and more than five times the size of the entire global subscription software market.

Also raising eyebrows is the fact that the recent deals among AI’s biggest players involve an ever-tightening circle of companies. For example, Nvidia plans to invest in OpenAI, which is buying cloud computing from Oracle, which is buying chips from Nvidia, which has a stake in CoreWeave, which is providing artificial intelligence infrastructure to OpenAI. As AI investing grows more insular, there is a risk that the money flowing between these companies is creating a “mirage” of growth. What is more, significant capital investment is being devoted to assets that depreciate quickly. Analysts believe most AI processors have a useful life of between three and five years9.

Concerns over a potential bubble led to wobble in equity markets in early November as AI enthusiasm temporarily cooled. However, corporate earnings remain strong and AI capex show no signs of slowing, suggesting the pullback was largely due to profit taking and valuation adjustments.

Moreover, the long-term potential for AI remains highly compelling for investors. Enterprise AI revenue has reached $14 billion, a 6-fold increase from the previous year. Moreover, only 3% of consumers are paying for AI tools; as adoption continues and technology improves, companies are expected to generate significant revenues through subscription models and add-ons. As well, AI’s potential extends far beyond the direct revenue of AI companies to transforming industries and boosting productivity. Forecasts suggest AI could add between $7 trillion (Goldman Sachs) and $15.7 trillion (PwC) to the global economy by 2030.

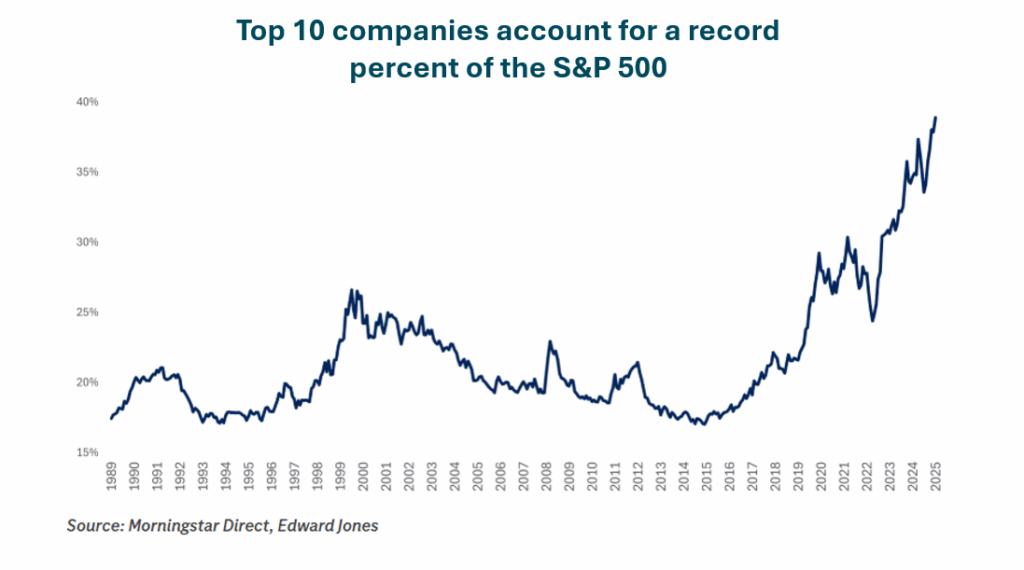

AI: Beware market concentration

The strong performance of AI stocks has led to substantial gains in household wealth as everyone with a retirement funds hold these Mega caps in their investment portfolio. However, as valuations for AI stocks continues to rise, equity markets have become increasingly concentrated. As an example, Nvidia’s share of the total S&P 500 market cap is a stunning 8 per cent, while that of the “Mag 7” is a record 37 per cent10.

While AI continues to serve as a compelling engine for long-term growth; investors are cautioned against concentrating investments solely in this theme. Any significant pull back in the demand for these stocks could lead to significant negative consequences for investor wealth.

A diversified strategy is therefore essential. A prudently constructed portfolio should be allocated across sectors, asset classes, and geographic regions that stand to benefit from increasing productivity across all sectors while minimizing the volatility from future market corrections.

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, Theresa Shutt, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

1 Data Centers At The Heart Of The AI And Digital Economy Surge, North America Data Center Report Midyear 2025

3 AI Energy Use in Everyday Terms – by Marcel Salathé

4 Energy demand from AI – Energy and AI – Analysis – IEA

5 What if the AI stockmarket blows up?

6 America is now one big bet on AI

7 GenAI Revenue Growth and Profitability | Morgan Stanley

8 OpenAI plans to spend $1t despite having $13b annual revenue

9 Spending on AI Is at Epic Levels. Will It Ever Pay Off? – WSJ

10 Big Tech, big spend. But big returns? – The Globe and Mail, Weekly stock market update | Edward Jones

AI Trends – 2026

20 February 2026