A Temporary Truce: The US-China Trade War

A Temporary Truce

In a joint statement released on Monday, the United States and China tapped the brakes on their trade war, agreeing to significantly reduce mutually imposed tariffs for 90 days. This agreement represents a massive concession for two global superpowers who had levied tariffs as high as 145% on each other.

In addition to fueling market volatility, the trade war between the U.S. and China brought almost $600 billion in 2-way trade to a standstill – resulting in plummeting business investment and increased layoffs, both of which significantly raised the possibility of a U.S. recession. The threat of higher consumer prices and empty store shelves added to the pressure on the U.S. administration to seek a solution with China.

While financial markets reacted positively to the news of the truce, significant uncertainty remains over whether a deal can ever be achieved, particularly in light of these nation’s opposing political ideologies.

US-China Trade Relations: A Brief History

Trade tensions between China and U.S. have been simmering since Trump’s first term in office when tariffs on China were first introduced.

Following the unprecedented supply chain disruptions caused by the pandemic, the U.S. was increasingly made aware of its growing dependence on China for everything from surgical masks to magnets. This realization only worked to worsen trade relations between the two countries.

Despite China’s promises during Trump’s first term to open its economy to more foreign companies and to import more U.S. goods, the Communist Party did the opposite. Chinese leadership moved to increase subsidies for factories and to tighten production chains to increase global dependence on Chinese goods. This action allowed China to produce certain goods (e.g. solar panels) so cheaply that many American manufacturers went out of business. In other words, flood the market to remove the competition.

In addition, President Xi Jinping directed the state-controlled banking system to lend more than a trillion U.S. dollars to foreign industrial borrowers to further increase reliance on China’s manufacturing sector.

This aggressive course of action was taken well before Trumps’s Liberation Day tariffs. As stated by the Central Committee of the Chinese Communist Party, these actions were taken with a longer-term goal to dominate the supply of critical goods to deter other nations from using tariffs or sanctions in the future. By ‘weaponizing’ the supply chain, Chinese leadership has been preparing for this moment for years.

As a centrally planned economy with power concentrated within the top, China has been able to successfully implement these sweeping policies without any challenges (even at the expense of increasing the standard of living of its population).

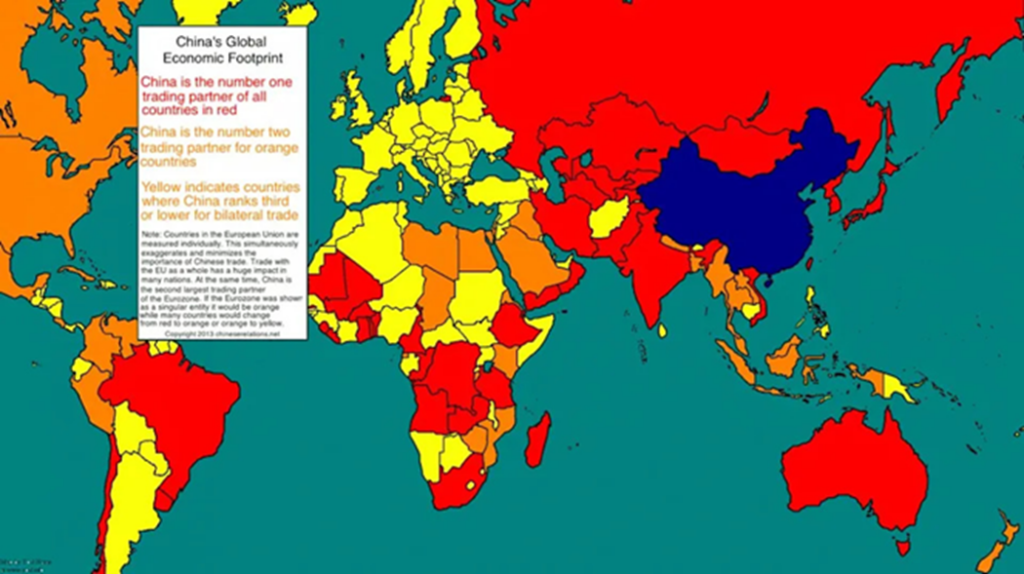

Today, 70% of economies worldwide trade more with China than with the U.S., compared to only 15% in 2001.

China’s trump card

In addition to retaliating with massive tariffs on U.S. imports, China was also prepared to impose export restrictions on a wide range of critical minerals essential for the manufacturing of an extensive range of products. According to the U.S. Geological Survey, China accounts for almost 70% of the world’s production of rare earths – critical minerals that are essential for semiconductors, data processing machines and advancements in defence and aerospace.

China now also dominates the production of lithium-ion batteries used to power electric vehicles and manufacturing robots and it is catching up quickly to the U.S. in artificial intelligence technology.

Who Would Win in a Trade War?

While the U.S. has a larger economy and sway over the global financial system, it is in fact, far more vulnerable in a U.S.-China trade war.

The key factor favouring China is the fact that the U.S. is levying tariffs on nearly all of its trading partners, whereas China is only clashing with the U.S. In addition, Chinese manufactured goods imported into the U.S. tend to be highly specialized, such as solar panels, batteries, phones, monitors and LED lamps. In contract, the U.S. exports highly substitutable commodities to China, such as agricultural products, which could easily be sourced from other suppliers on the international market.

Also, one shouldn’t forget that China owns a significant amount of U.S. debt. China currently owns over US$750 billion in U.S. Treasury bonds and several hundred billion dollars of mortgage-backed securities, which if sold, could significantly disrupt the U.S. bond market.

The rivalry between these two behemoths has now expanded into the global sphere with countries being pressured to choose sides. The U.S. is pressuring nations to impose tariffs on China while China is threatening to punish nations that do so.

While U.S. and China have called a truce, the outcome of the negotiations is highly uncertain, as both leaders are known for their dogmatic and inflexible views. While Trump has vowed to “Make America great again”, President Xi has pledged to pursue “the great renewal of the Chinese nation”. To the extent that these objectives are in conflict, a resolution may not be achievable.

From a global perspective, the stakes could not be higher. If not resolved, a trade war between these two economic giants could lead to slower global growth, inflation and massive supply chain dislocations. There is also a significant risk that if certain products are not able to enter the U.S., Chinese companies would “dump” these goods on the world market, fueling corporate bankruptcies globally.

Every government leader will be watching the progress of negotiations closely. While China will be more directly impacted by a trade war, it has become clear over the past month that America has a much lower tolerance for economic pain. If common sense prevails (as opposed to bluster and bravado), an agreement could be within reach. We’ve seen Trump successfully negotiate a final deal with Britain and one hopes that this pattern continues.

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, Theresa Shutt, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

AI Trends – 2026

20 February 2026