New labour data shows 3x more jobs created in June than expected

Statistics Canada has announced 60,000 jobs were created in June, 3x the level expected! Christine Tessier, Harbourfront Wealth Management’s Chief Investment Officer, shares key takeaways from employment announcements in Canada and the US:

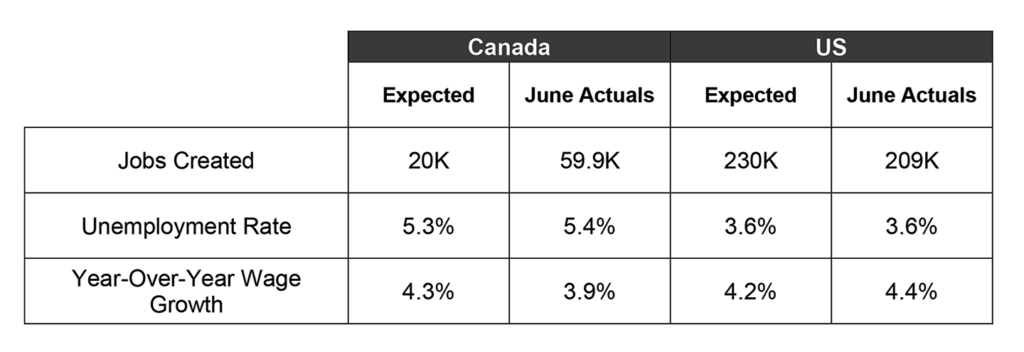

The underlying data shows strength with the latest Labour Force Survey, with strong full-time job growth in Canada (109.6K), though 49.7K part-time jobs were lost. In this month, Canada experienced higher job creation with slower wage growth.

According to Statistics Canada, the employment increase in June was the largest since January 2023. Employment growth had moderated from February to May (averaging 20,000 per month), following strong growth from October 2022 to January 2023 (averaging 79,000 per month).

The US Department of Labor also recently announced lower job creation with higher wages.

“The Bureau of Labor Statistics reported that the American economy added 209,000 jobs in the month of June, and the unemployment rate ticked down to 3.6 percent, continuing the longest stretch of sub-4 percent unemployment since the 1960s,” said Julie Su, US Acting Secretary of Labor, in a statement on the June 2023 Employment Situation report.

The table below summarizes key labour statistics in both Canada and the US:

Expect another rate hike in July

The jobs market and employment data remain a key metric on which Central Bank policy is anchored. The resilience of employment provides strong support for central bankers to raise rates.

I expect the Bank of Canada to hike rates another 0.25%, with a decision expected on July 12, on the back of this strength in employment data. Similarly in the US, the Fed is also likely to follow through on its signal of further rate hikes.

If you would like to discuss what this and future rake hikes mean for your portfolio, I encourage investors to connect directly with your advisor.

Christine Tessier

Chief Investment Officer, Harbourfront Wealth Management

Disclaimer

I, Christine Tessier, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q2 2025

7 July 2025